Highlights:

|

Risk provision is an important topic in all GAAPs.

Nonetheless each GAAP answers the following questions in a different way:

- At which point in time should a risk be considered in the balance sheet and income statement?

- How much provision should be considered?

Jabatix provides the following components as instruments for the configuration, simulation and consideration of risk provisions in financial statements:

For GAAP-specific usage, please refer to the specific sections. For IFRS 9 please refer to IFRS 9 Blueprint Impairment.

The result of the risk provision process in Jabatix are

- Debit/credit entries and

- Data marts

These data marts support detailled analyses, for example:

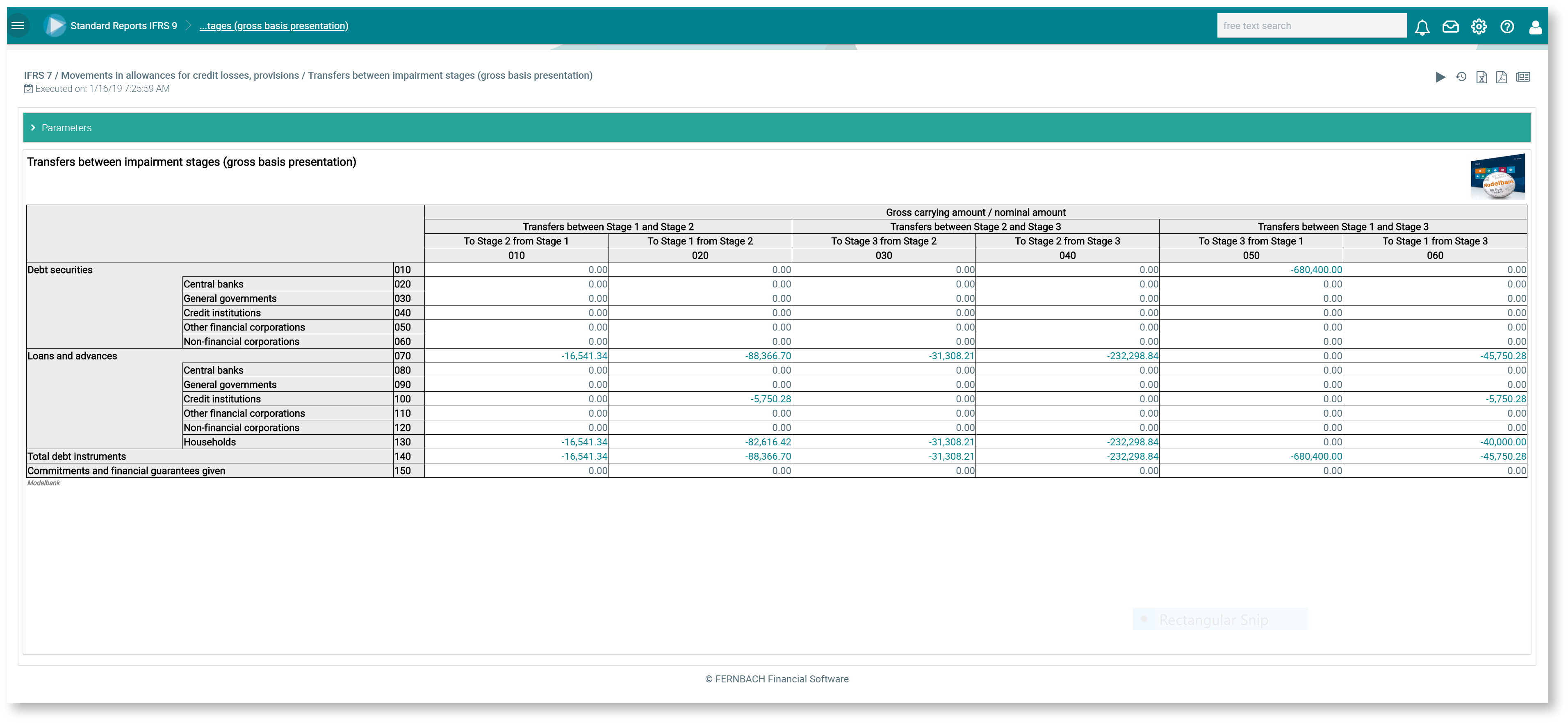

Figure: Transfers between impairment stages (gross basis presentation)

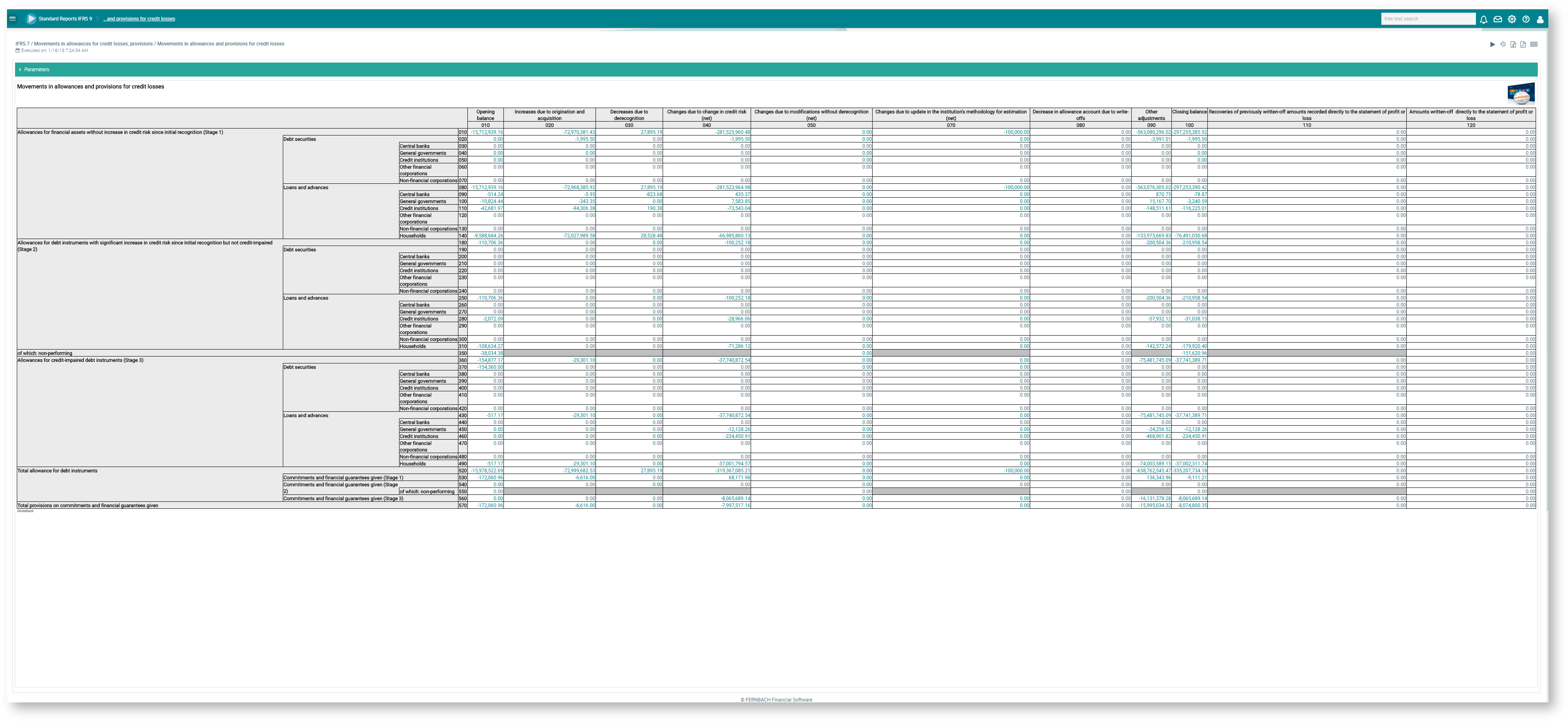

Figure: Movements in allowances and provisions for credit losses