Credit protection is generally an instrument for risk mitigation. Wherever a creditor does not want to bear a claim or financial risk, he has the option of hedging it. The purpose of collateral is to reduce the moment of uncertainty inherent in the lending business as far as possible.

The agreement on the provision of collateral is called the security agreement, the contracting party requiring the loan collateral is called the collateral taker, the party providing the collateral is called the guarantor. The collateral provider does not have to be the borrower, but the collateral taker is always also the lender.

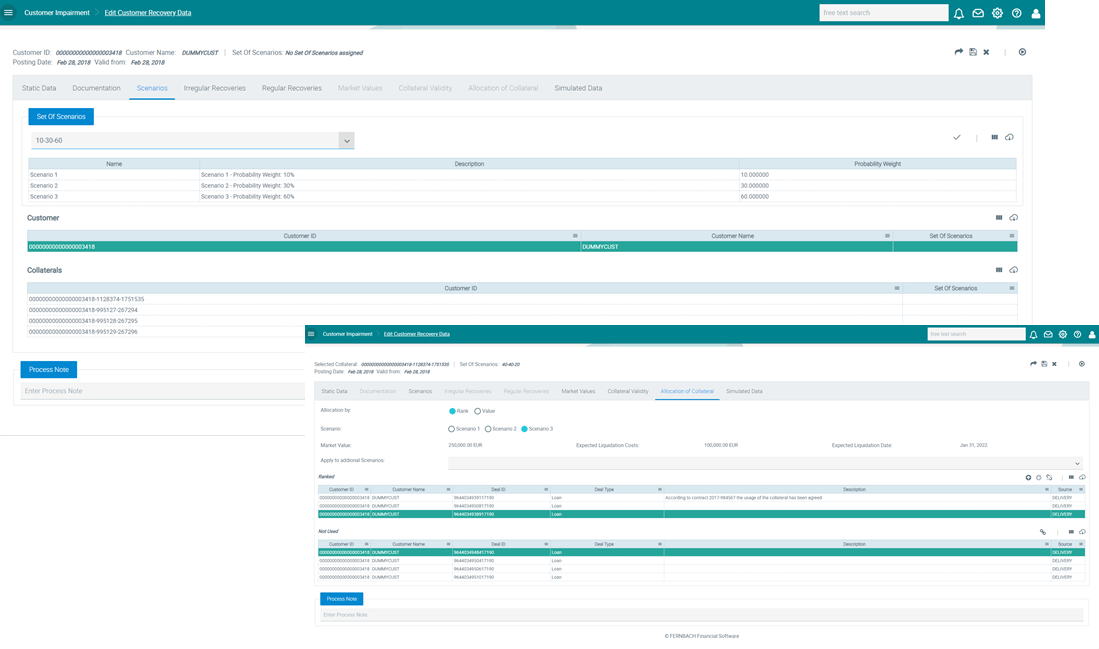

The collateral management is embedded in the UI of the Customer Impairment Workbench.

Jabatix supports the following aspects regarding collateral:

- Market value

Market values can be maintained for collateral. Market values for collateral can be adjusted by automatic haircuts or through individual values manually captured and assigned by a user. - Validity

Collateral can be valid for exactly one or alternatively for several multiple individual assets.

Jabatix supports the definition of validity rules and allocation of collateral to individual deals. Allocation

The enitre amount of collateral can be allocated to one individual deal or portions of collateral can be allocated to multiple financial assets. These assets can belong to exactly one individual customer or many customers of the same economic unit.

In order to calculate the individual risk provision, an item of collateral can be allocated using manually captured specific values or by ranking of deals. The rank can be manually or automatically assigned to a deal.

Collateral in FX can be allocated with a variable or a fixed FX exchange rate.

Figure: Collateral, scenarios and collateral allocation

- Simulation

Jabatix supports the simulation of risk provisioning for different scenarios of collateral allocation, and by doing so, the impact of collateral validity and allocation to specific risk provisions can be analysed before final approval and before consideration in financial accounting.

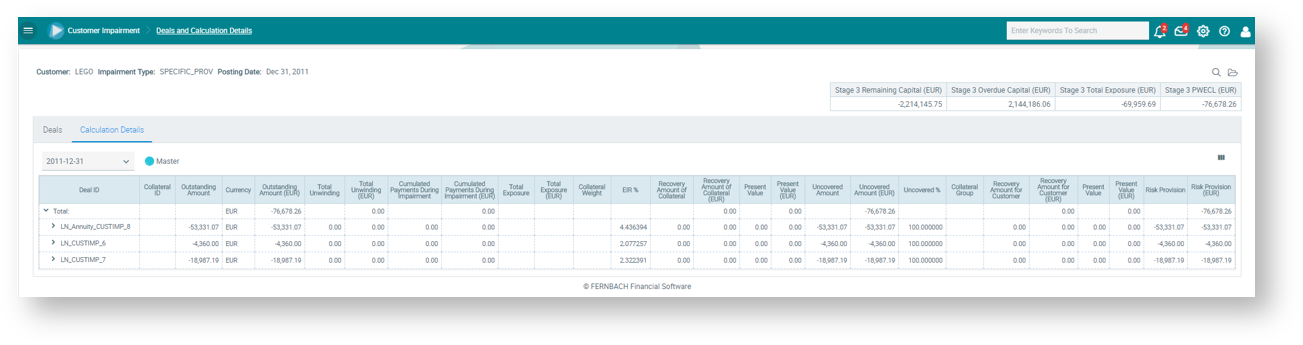

- Collateral during Expected Credit Loss calculation

Jabatix considers the collateral values allocated during- Expected Credit Loss calculation using statistical methods in stage 1 and 2 as well as non-significant deals assigned to stage 3

- Expected Credit Loss calculation using individual recovery cash flows for stage 3 significant deals

- For details of the calculation for stages 1 and 2, please refer to Impairment IFRS 9 Stages 1 and 2.

- For stage 3, non-significant deals in a lump-sum specific approach, an Expected Credit Loss model needs to be defined in the Collective Impairment Workbench that calculates the Expected Credit Loss on the basis of an adjusted EAD

- For stage 3 significant deals in a specific provision approach, collateral is a source for recovery cash flows besides other recovery types. These recovery cash flows are discounted and compared with the total exposure.

- For details of the calculation for stage 3, please refer to Impairment IFRS 9 Stage 3.

The different scenarios lead to a probability-weighted Expected Credit Loss for stage 3 impaired significant deals.

Figure: Expected Credit Loss calculation results at individual deal level for specific provisioning