Highlights:

|

IFRS 9 differentiates three different models of risk provisioning:

- Credit deterioration model

In this model, a deal will be assigned depending on its deterioration in credit quality to one of three stages. Each stage has specific requirements regarding the calculation of the expected credit loss (ECL). All financial assets are considered in this model if they do not fullfil the conditions for the following models.

- Simplified model

This model is used for trade receivables which is a simplified version of the credit deterioration model.

- Purchased or originated credit-impaired (POCI) deals

POCI deals are financial assets that are credit impaired at initial recognition.

After the introduction of IAS 39 in recent years led to a worldwide harmonisation of accounting standards, the effect was further intensified by IFRS 9. IFRS 9 has been introduced in numerous countries or is about to be introduced. In addition, numerous local accounting standards have been made accessible for IFRS values.

This means that IFRS 9 result measures may also be used in local accounting. This applies, in particular, to the result measures in the context of risk provisioning, as local financial reporting is said to be "too little and too late" in relation to the above issues.

Therefore, the focus in this section is set on risk provisioning that follows IFRS 9 rules that determine risk provisioning for expected credit losses.

Under the impairment approach in IFRS 9, it is no longer necessary for a credit event to have occurred before credit losses are recognised. Instead, an entity always accounts for expected credit losses and changes in these expected credit losses. The amount of expected credit losses is updated at each reporting date to reflect changes in credit risk since initial recognition and, consequently, more timely information is provided about expected credit losses.

IFRS 9 calls for banks to determine an expected credit loss amount on a probability-weighted basis as the difference between the cash flows that are due to the bank in accordance with the contractual terms of a financial instrument and the cash flows that the bank expects to receive. Although IFRS 9 establishes this objective, as a principal-based approach it generally does not prescribe particularly detailed methods or techniques for achieving it.

When using historical credit loss experience in estimating expected credit losses, it is important that information about historical credit loss rates is applied to segments that are defined in a manner that is consistent with the segments for which the historical credit loss rates were observed. Consequently, the method used should enable each group of financial assets to be associated with information about past credit loss experience in segments of financial assets with shared risk characteristics and with relevant observable data that reflects current conditions.

In general, the IFRS 9 impairment model involves three stages that determine how impairment and interest revenue are recognised. It is relevant for financial assets that are measured at amortised cost (AC), e.g. loans or trade receivables, and other debt instruments that are measured under fair value through other comprehensive income (FVTOCI). Moreover, it also applies to certain financial guarantee contracts and loan commitments.

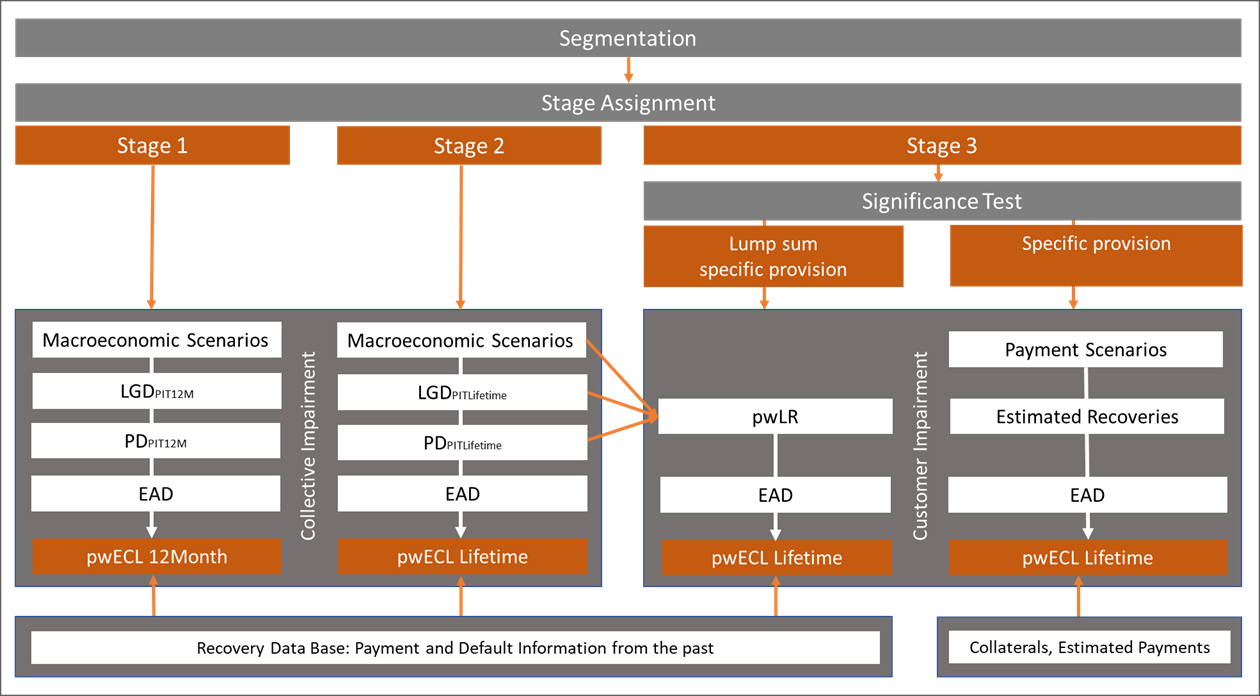

The process chain for risk provision includes the following functional steps:

Besides the components for segmentation and stage assignment, the following components are important for the treatment of risk provision under IFRS 9:

The blueprint for IFRS 9 impairment is composed of the following components and other blueprints:

In order to optimise operational processes, simulations can be determined several times irrespective of the current accounting process and the month-end processing. A comprehensive audit trail and audit compliance for data and methods are available for all calculations.