Highlights: |

The International Financial Reporting Standards (IFRS) set out requirements regarding the classification and measurement of financial instruments.

Jabatix covers the entire set of IFRSs with major focus on financial instruments.

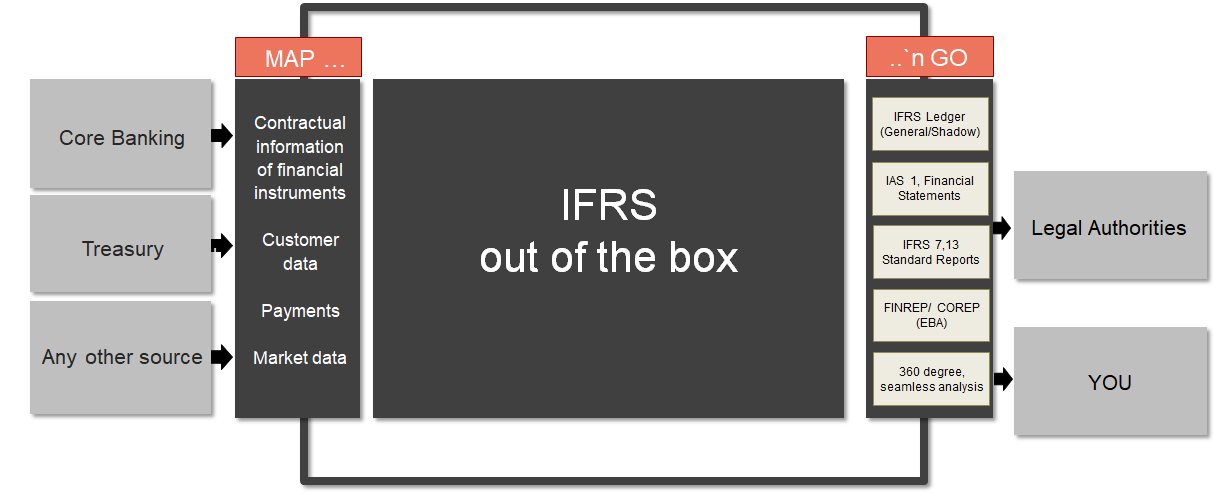

It supports the process chain end-to-end.

Starting point is raw contractual information of financial instruments, customer data, payment information and market data.

For IFRS 9, the solution covers:

- Categorisation of financial assets and liabilities – IFRS 9 Categorisation Blueprint

- Initial and subsequent measurement – IFRS 9 Valuation Blueprint

- Impairment and risk provisioning – IFRS 9 Impairment Blueprint

- Financial Accounting (General Ledger / Accounting Rules Engine)

- Financial statements and notes

For different steps in the process chain for initial and subsequent measurement individual components are available.

This ensures that only for your individual solution required components need to be implemented.

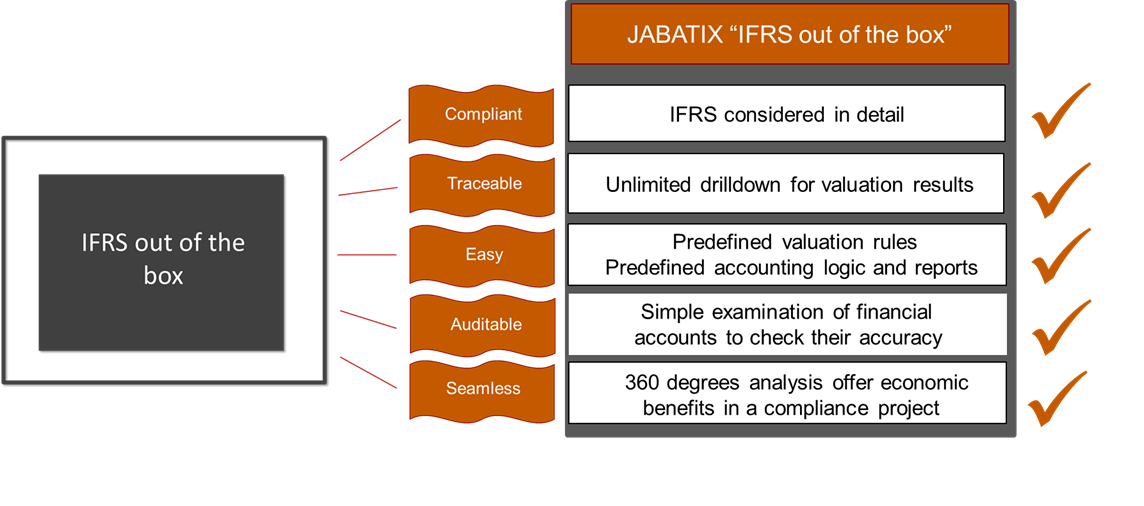

The sum of components for IFRS is available as an "Out-of-the-Box" solution.

After mapping basic input data, the Out-of-the-Box solution provides required output for legal authorities. It too enables you to perform 360 degrees analysis of your business, considering valuation results, journal entries, descriptive deal as underlying for seamless breakdowns of and drilldowns into your business.

The "IFRS out of the box solution" contains IFRS-compliant rule sets such as

- Standard chart of accounts,

- Standard accounting rules,

- Valuation rules (e.g. "When shall an EIR be recaclulated for which time window") and

- Predefined Reports