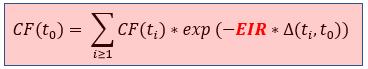

The effective interest rate (EIR) for a deal is calculated using the following formula:

Here CF(t0) represents the initial cash flows for the deal (i.e. the outpayment of the nominal amount by the bank plus/minus possibly arising transaction costs, premiums/discounts or upfront payments), CF(ti) stands for the cash flows for the deal at further payment dates ti and Δ(ti,t0) is the time gap between payment date ti and deal orgination date t0.

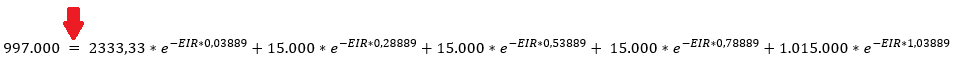

Hence, the EIR is calculated by implicitly solving the above non-linear equation. In the solution, this is performed by using a Newton iteration.

The above formula expresses that the EIR exactly discounts the estimated future cash payments or receipts through the expected life of a financial instrument to its net carrying amount.