The open amortisation describes the amount of amortisable transaction costs which will be distributed in the future based on the EIR. The calculation of the open amortisation requires several steps:

Initially, the amortised cost of a deal equals the negative of its original costs:

At further payment dates, the amortised cost equals the amortised cost of the previous payment date, plus the difference of the current cumulative total amortisation TA(tn) and the one from the previous payment date TA(tn-1), plus possible principal repayments PR(tn):

The cumulative total amortisation TA(tn) of payment date tn is defined by

The open amortisation is then calculated for transaction cost by the difference between

- the sum of the amount which was originally subject to be amortised based on the EIR and

- the cumulative total amortisation.

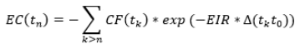

The effective capital EC(tn) of payment date tn is defined as the negative of the sum of all future cash flows discounted by the effective interest rate:

In order to check the calculation of the effective capital in Excel exports of the calculation analyser, the following equivalent recursive formula for the effective capital is useful: