The business transaction ‘Changes in Interest Rates’ is provided for changes in the interest rate for an existing deal. This causes a change in the loan instalments while retaining the term for the deal. If the interest rate increases, the instalments increase whereas if the interest rate decreases, the instalments decrease. The next due date for payment, which is the date for changing the interest rate agreement and the annuity, is determined on the basis of the current posting date and the payment frequency.

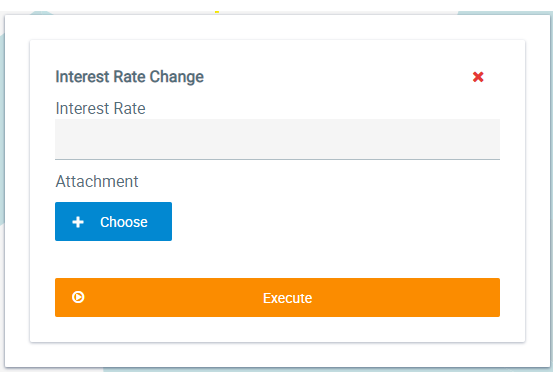

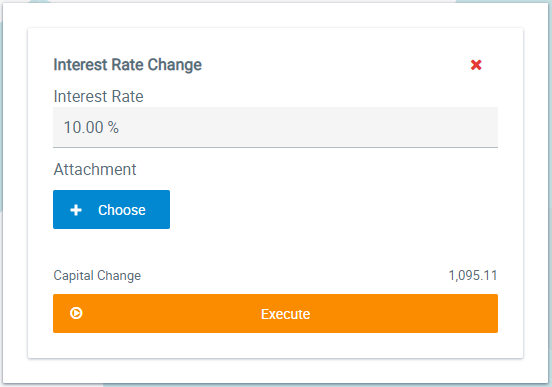

A preview of the new loan instalment expected is provided (in the diagram below ‘Capital Change’) when the user enters a nominal interest rate and exits the field.

After the data have been entered, the change to the deal is shown by clicking on "Execute” and confirming by clicking on .

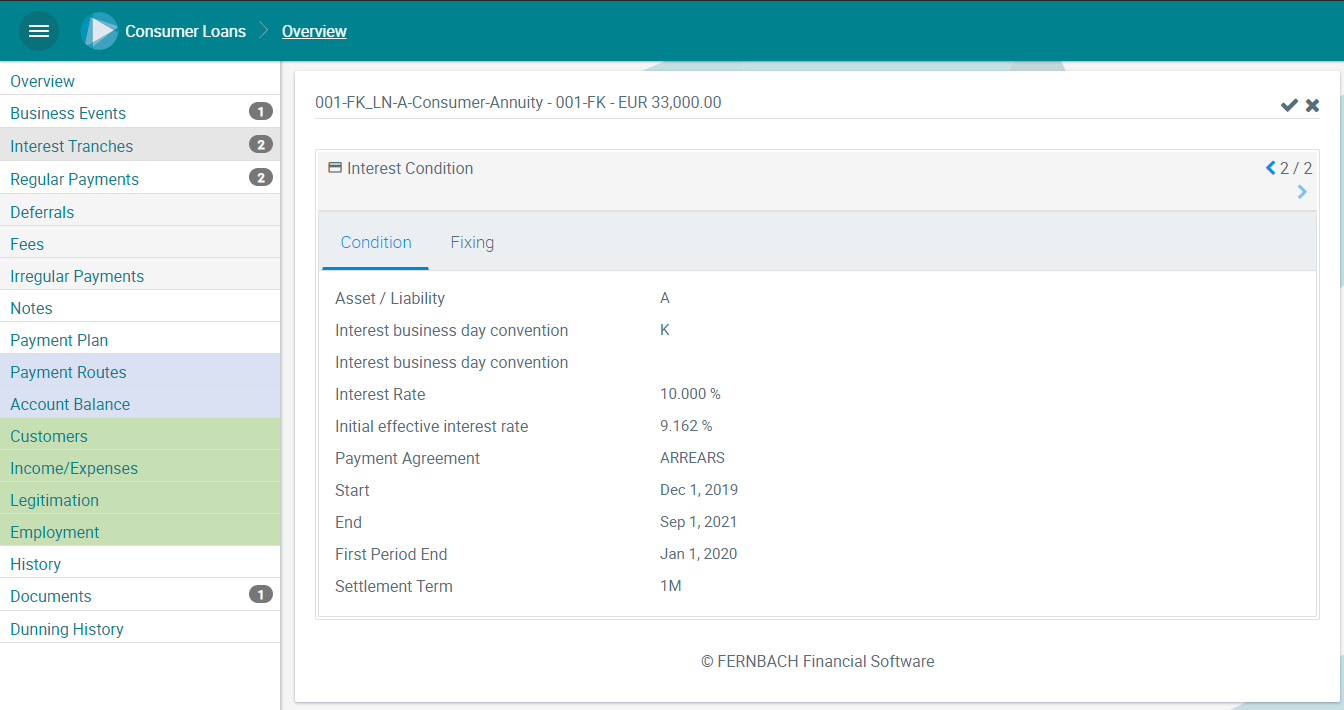

The change to the interest rate agreement is displayed

- in the payment plan

- in the side index for the interest rate agreement

- in the side index for repayments/annuities

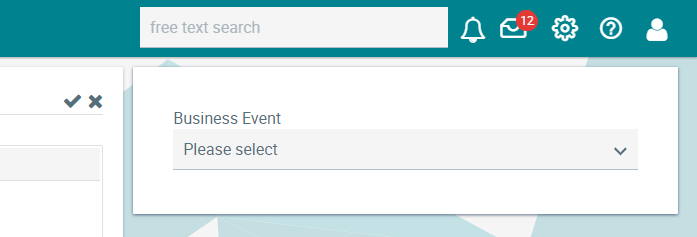

- for business transactions.

Display of the new interest rate agreement in the side index for interest rate agreements:

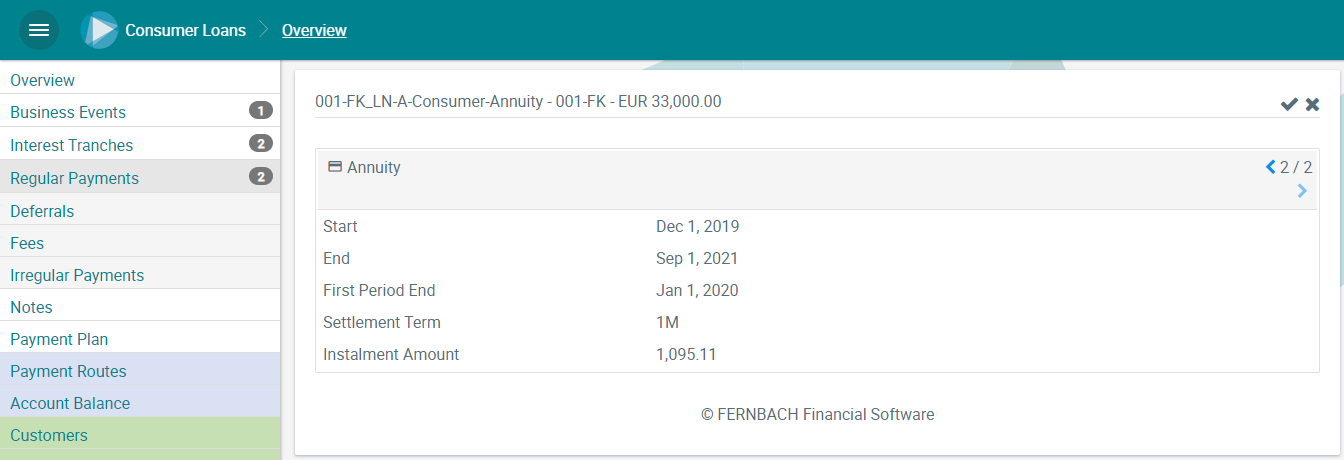

Display of the new annuity in the side index for repayments/annuities:

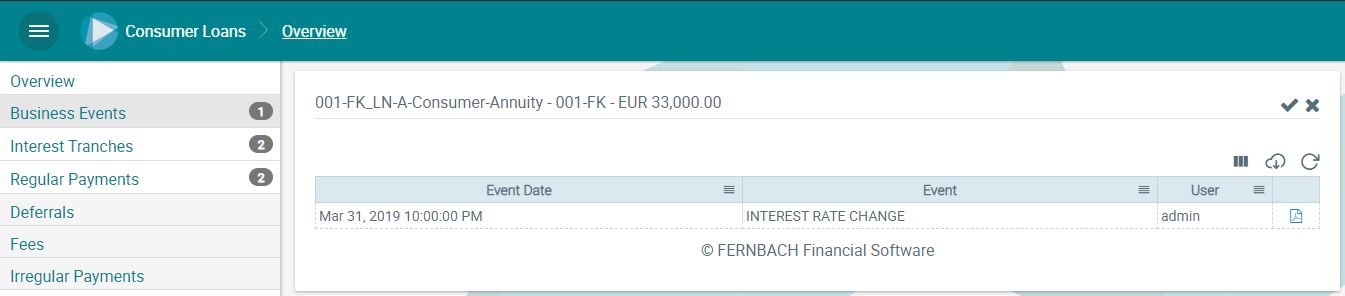

The trigger for the business transaction for the changes to interest rates is documented in the appropriate side index: