In general, IFRS 9 differentiates between 3 accounting categories:

- Amortised Cost;

- Fair Value through other comprehensive income; and

- Fair Value through other profit and loss.

The solution operates with five accounting categories that help to reflect valuation as well as specific disclosure requirements.

- AC At Amortised Cost

- HFT-FVTPL Held for Trading

- FVTPL At Fair Value Through Profit and Loss

- FVO Fair Value Option

- FVOCI At Fair Value Through Other Comprehensive Income

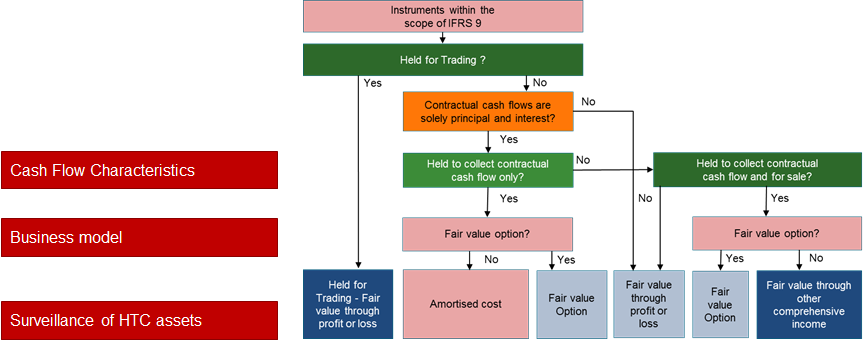

The following table shows in total 5 different accounting categories that should be differentiated in accordance with IFRS 9.

The columns show different attributes of the business model and the rows show the necessary differentiation between the characteristics of the cash flows.

Diagram: IFRS 9 accounting categories in the solution

The consideration of 5 different accounting categories supports the assignment of

- Individual deals to valuation approaches AC, FV

- Valuation elements to P&L or OCI

- Individual deals to report positions (“Held for trading”)

The assignment of a financial instrument to an accounting category is based on

- Business model as well as

- Characteristics of cash flows

The diagram below shows the conceptional framework of account classification for financial assets and financial liabilities in the solution.

- The five accounting categories,

- The differentiation between assets and liabilities.

Based on the combination of an accounting category and the asset side or liability side, the diagram below shows the differentiation, if and how fair value changes related to market prices and fair value changes related to the changes in credit risk are considered in

- Financial acounting and

- Financial reporting.

Diagram 1 refers to the underlying IFRS 9 rules.

Diagram 1: IFRS 9 accounting category assignment and impact on valuation elements

In general, the classification process requires the analysis of the following questions for each product design:

Diagram 2: IFRS 9 category assignment rules

If the assignment of an accounting category changes during the lifecycle of a financial instrument, a reclassification will be triggered.