...

Highlights:

|

...

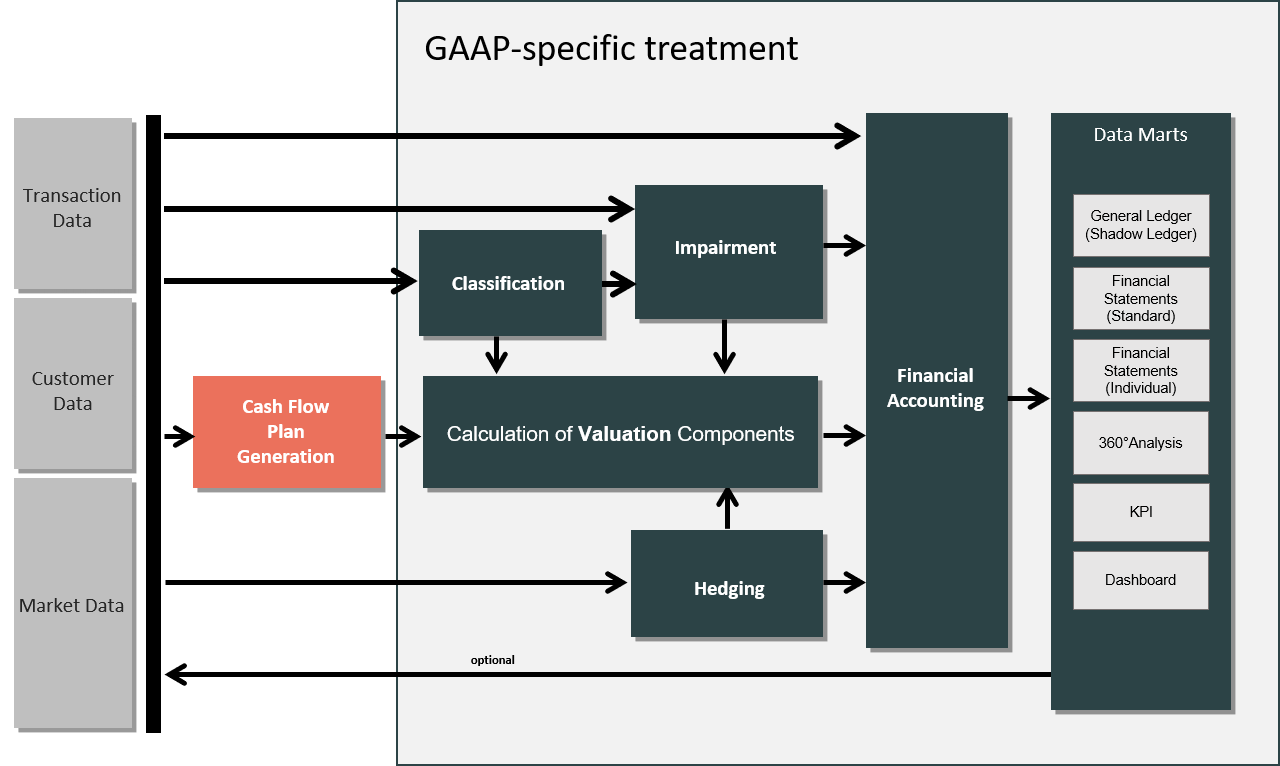

- Generation of the

- contractual cash flow plan on the basis of imported contractual agreements, reflecting maturities of business events

- estimated cash flow plan taking expectations about customer behaviour regarding early repayment behaviour into account, in addition to contractual maturities

- Classification of the deal. A A specific accounting category can be assigned for each GAAP. An accounting category is decisive for determining which valuation elements are to be considered and how they are to be considered, e.g. if fair-value-specific valuation elements such as fair value changes related to changes in market prices are to be posted and if they are to be considered in profit and loss or in comprehensive income.

For classification purposes, different rule sets can be applied, taking descriptive parameters of a financial instrument such as the business model into account or analysing cash flow characteristics. - Calculation of valuation elements related to the accounting category

- Generation of debit/credit entries by the Accounting Rules Engine

- Provision of valuation results, journal entries and account balances in specific data marts in the result layer.

...