Jabatix supports financial accounting in parallel GAAPs.

Parallel GAAPs can be defined as

- Completely independent parallel GAAPs

Each GAAP contains a completely independent chart of accounts. Each GAAP covers the entirety of valuation elements. These valuation elements are not another GAAP. The chart of accounts and accounting logic can be completely different in each parallel GAAP.

- Adjustment of GAAP

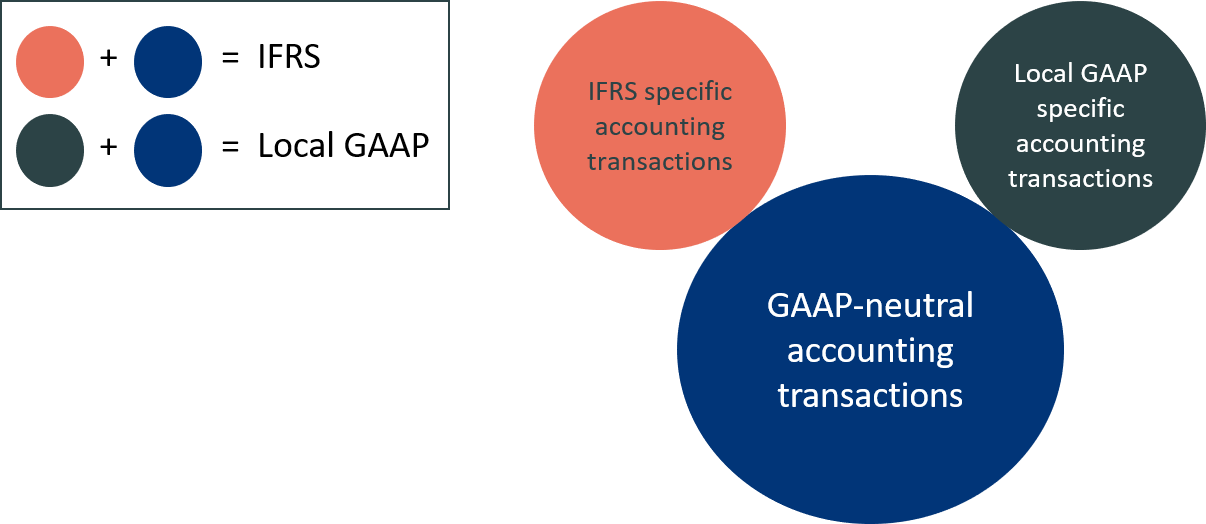

The basic idea of adjustment accounting is the segregation between GAAP-individual and GAAP-unique business events. Depending on the dimension of the diversity of the GAAPs, different adjustment approaches can be implemented:- Simple adjustment (“Rucksack solution”)

This approach works in the existing local GAAP with specific general ledger accounts that reflect international reporting requirements. These accounts of the adjustment GAAP are faded in or out in financial statements replacing general ledger accounts reflecting local GAAP values.

Example: Two GAAPs are only different with regard to the approach on how transaction costs are to be allocated to fiscal periods and/or how to consider credit risk in risk provisioning. In such a case, one GAAP can be defined that includes all the elements (usually covered by local GAAP) and in addition, an adjustment GAAP can be defined that solely considers the amortisation of transaction costs (= GAAP-non-unique valuation element) and/or the specific risk provision. Please also consider the explanations concerning the General Ledger and Shadow Ledger approach.

- Advanced adjustment

Instead of using a general ledger that represents a complete GAAP as a basis, the advanced adjustment works with a “neutral GAAP" that contains the chart of accounts and all valuation elements that are the same for all GAAPs. This builds the “head of the mouse” in the picture. The “two ears of Mickey Mouse” are then added metaphorically. One represents the national GAAP, in which all local GAAP-individual valuation elements are calculated and posted. The second ear depicts a separate set of books for every international GAAP applicable to the entity, in which all GAAP-individual valuation components are calculated and posted in compliance with international regulations – e.g. IFRS. If more accounting standards are required, they can be added as independent sets of books (Metaphorically termed “additional ears”). The balance sheet and P&L views for the individual local and international GAAPs consist of the basic GAAP and the relevant local or international GAAP for which the balance sheet, P&L, or financial report is to be created. In this way, GAAP-like facts are guaranteed to be consistently valuated across all accounting standards and posted exactly once.

- Simple adjustment (“Rucksack solution”)

For each GAAP specific individual rules can be defined for

- Classification of financial instruments. For each GAAP, the classification decides which valuation approach is to be applied, and how the asset or liability is to be represented in financial statements

- Valuation. Different GAAPs require various GAAP-specific valuation requirements for performing and non-performing assets as well as for liabilities

- Financial accounting where a GAAP-specific chart of accounts for parallel GAAPs or adjustment GAAPs can be defined.

(For details on how to define a chart of accounts and/or the accounting logic for a specific GAAP, please read more in the manual: General Ledger/Shadow Ledger, Chart of Accounts, Accounting Logic.)

The process chain as well as GAAP-specific topics are explained in the following for different GAAPs.