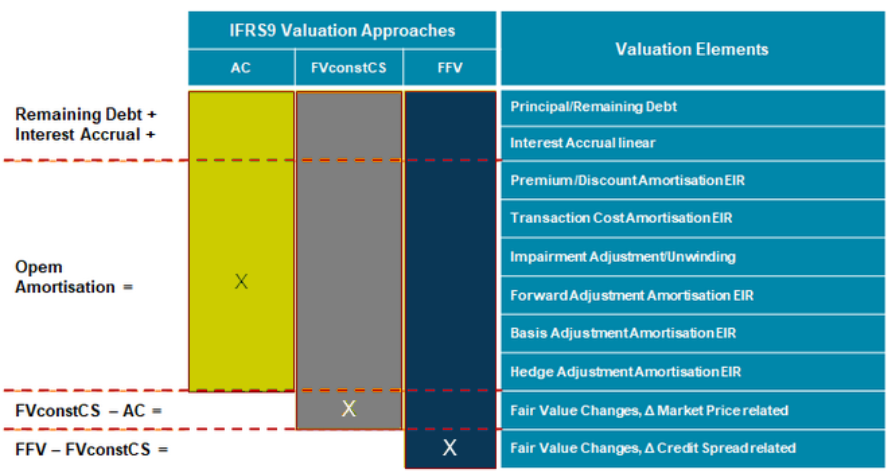

In the solution, instead of solely calculating THE Amortised Cost or THE Fair Value, these valuation approaches are split into valuation elements such as principal, outstanding amortisation of transaction costs, fair value changes related to changes in market price, etc.

Figure: Fine-granular valuation elements in the solution

Due to the provision of valuation elements combined with the fine-granular posting of each element, the solution ensures compliance and offers new perspectives:

- Solid basis for future reporting requirements

Example:

Regulator introduces the separate disclosure of credit spread related to fair value changes

- Fine-granular analysis of the balance sheet and income statement

Example Liquidity:

The differentiation within the AC valuation approach between paid interest, linear accrued interest in arrears and the amortisation of transaction costs enables a differentiation regarding the impact on liquidity:

'Which volumes in P&L impacted liquidity in the past, but will impact the income only in the future?' or 'Which volumes impact the income, but will have a liquidity impact only in the future?'

Example of the impact of changes in rating/credit spread for the income statement:

'How does the increasing credit spread for a specific group of customers impact the income statement?'

- Useful basis for the comparison of different GAAPs

Valuation elements which are unique over all GAAPs can be used for reconciliation between the different GAAPs.