General information

The Jabatix loan calculator supports all types of loans. The payment plan and the ratios are determined with the help of the loan calculator.

Calculation results

The overall lending amount, the total interest and the initial effective interest rate are determined as ratios.

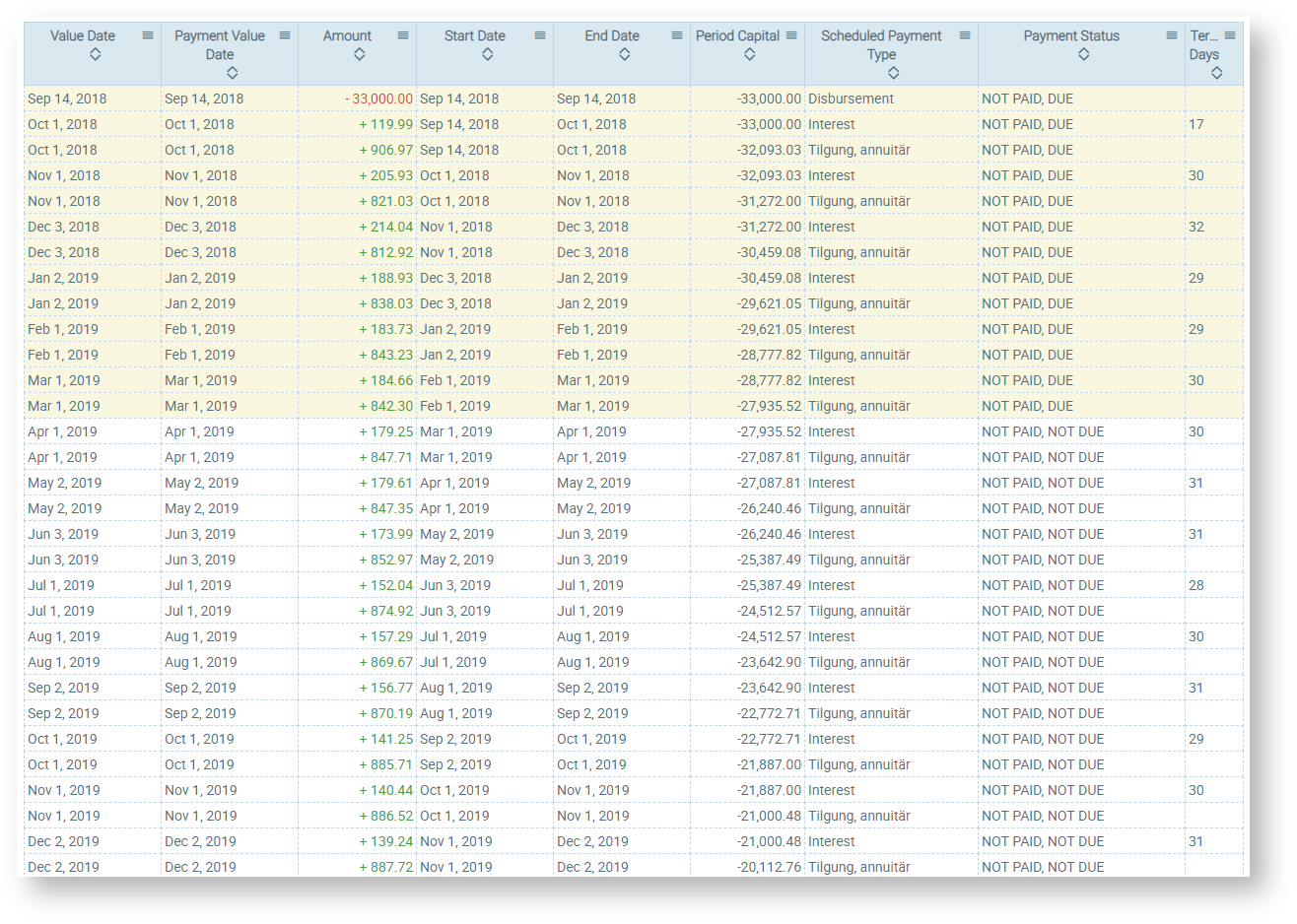

The amounts and dates for the payouts and repayments are presented in the payment plan.

Figure 1: Repayment plan for an annuity loan

Input values

The calculation takes into account the following business rules, if required:

- Net lending amount/payouts

The net lending amount represents the total funding amount which is made up of all the payouts. This includes one-off payments such as the normal loan disbursement as well as in-house and third-party discharges, insurance premiums etc. In addition, regular payouts can also be included.

- Interest rate agreements

The loan calculator can calculate the amount of interest on the basis of fixed or variable-rate interest agreements. In this case, various day count conventions, business day conventions/public holiday calendars and payment agreements are taken into account. Usually only one fixed-rate interest agreement for the entire repayment term exists for consumer loans. In this case, a nominal or effective interest rate can be defined for the calculation of a loan and the value missing in each case is determined. Sales are driven by effective interest rates particularly in the consumer lending business.

Jabatix provides various options for determining interest rates. This ranges from the simple, flexible manual entry of interest rates, predefinition in the catalogue of products and conditions, to the fully automatic determination of a fair target condition specific to the situation and the customer (see Interest Conditions). Variable interest rate agreements are also possible.

- Repayment agreements

The repayment of the loan can be calculated flexibly by the loan calculator. In the case of consumer loans, repayment is usually made on an annuity basis, meaning that the monthly repayment instalment is the same, but the interest portion and repayment portion are different for each instalment. Of course, the loan calculator can also map amortisable loans in which repayments and interest payments are not interdependent.

Irregular repayments can also be included in the repayment agreement and can shorten the repayment term accordingly in the repayment plan.

In the case of consumer loans in the form of annuity loans, the loan calculator provides a high degree of flexibility for optimum advice to the borrower on terms and conditions, because either an instalment amount or the number of instalments/repayment term can be specified for the loan calculation, and the missing value is calculated in each case.

- Charges and commission

The loan calculator can take a wide range of charges and charge models into account and disclose the corresponding payments in the payment plan. These can be fixed charges (e.g. legal transaction fees) or, for example, charges relating to the loan amount or the remaining capital.

- Deferred start of instalment payments (grace period)

The start of repayment can also be deferred.

- Suspension of payments (payment holiday)

The payment plan can take account of the fact that payments are suspended on fixed dates. Suspensions may be one-off or annual. This extends the repayment term and gives the borrower more financial leeway.