In view of the fact that entities became accustomed to posting interest on the basis of the nominal interest rate, the EIR contains more components that can be treated differently in traditional accounting practice:

- Nominal interest income is still an essential part of the EIR. Similar to traditional accounting standards, it is calculated using the nominal interest rate and the day count convention defined in the contract.

- Smoothing effect:

Even for a financial instrument that only has interest and capital repayment cash flows (i.e. a financial instrument without any premiums/discounts/charges/transaction costs), its EIR is different from its nominal interest rate. The reason for this is the underlying formula (see also the corresponding example): For calculating interest cash flows, a linear factor is applied and an exponential factor is used for EIR calculation. - For a loan without any premiums/discounts/charges/transaction costs, the smoothing effect represents the difference between the nominal interest rate and the effective interest rate.

- The total sum of the smoothing effect is 0, meaning that the total sum of the effective interest equals the nominal interest for a plain financial instrument without anything to be amortised.

- The amortisation of premiums/discounts/charges/transaction costs represents the difference between the initial amount and the maturity amount.

- For a financial instrument with premiums/discounts/charges/transaction costs, the sum of the three components “nominal interest income”, “smoothing effect” and "amortisation" represents the theoretical effective interest as defined in IFRS 9.

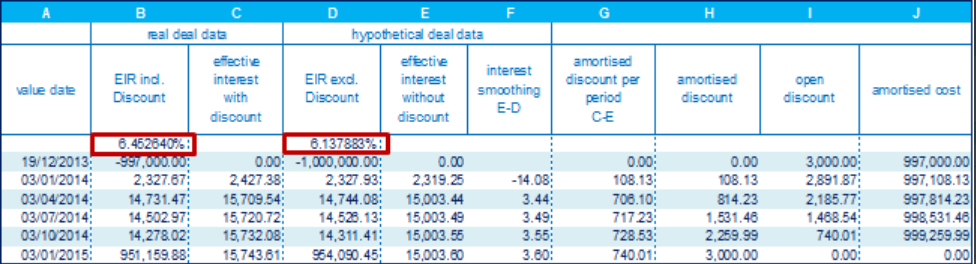

- Considering the same sample deal of the regular EIR the smoothing EIR is calculated in addition to the regular EIR. Ignoring the initial discount with a value of 3000, the following equation needs to be considered in order to derive the smoothing EIR:

- The solution to the equation results in an approximated value for EIR = 6.137883%.

The interest smoothing is shown in column F below: