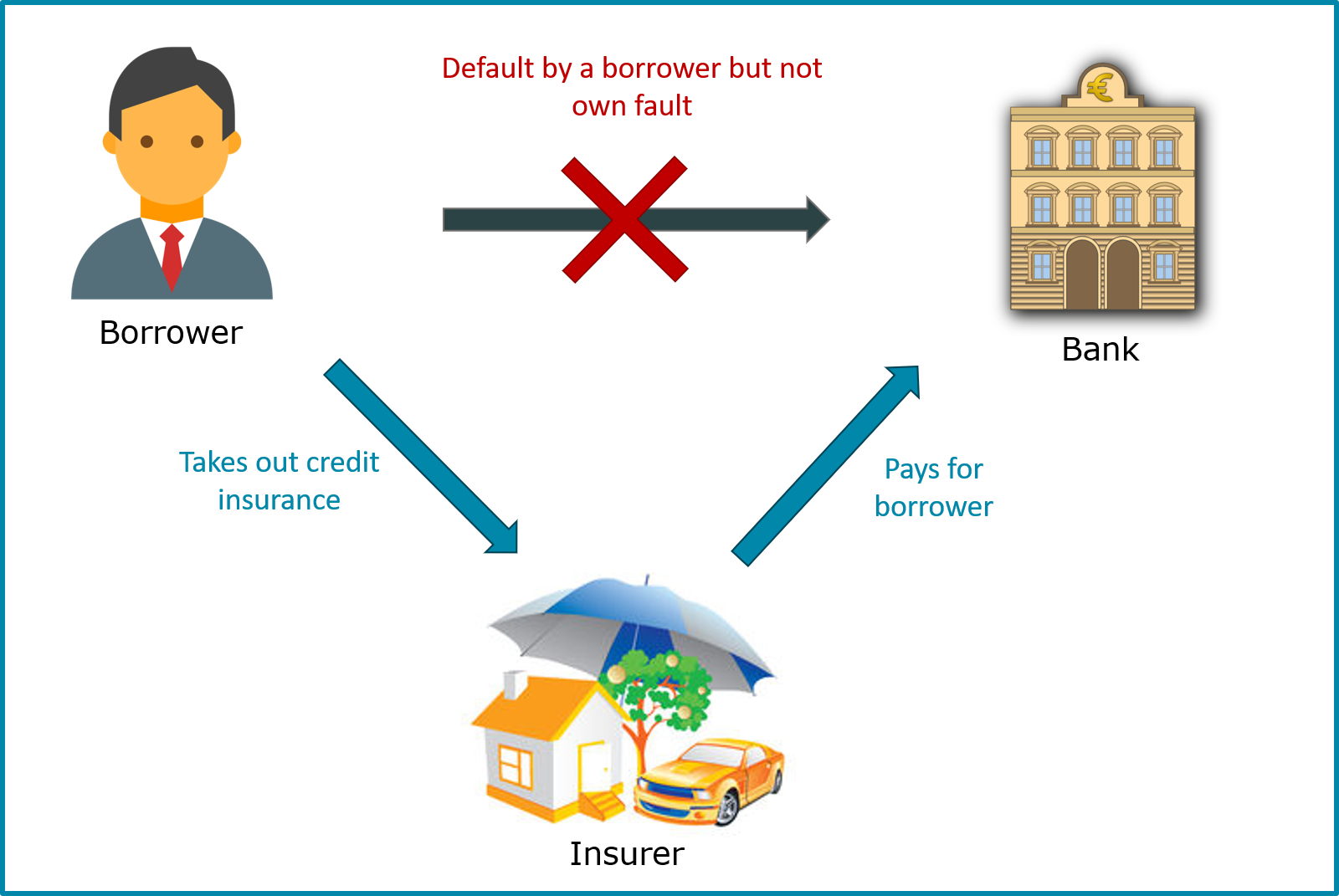

Insurance plays an important role in the sale of consumer loans. On the one hand, it is important for the borrower and the bank in order to secure the loan repayment, and on the other hand, for the bank because it has the opportunity to increase income from the sales or brokerage commission.

When concluding a lending agreement, it is often advisable for borrowers to take out insurance. Insurance products can be provided for this purpose. Jabatix can integrate different insurers and flexibly offer individual products or combined insurance packages according to the situation.

The main focus here is on life insurance by means of a residual credit insurance as well as property insurance such as cover in the event of incapacity to work and unemployment. The insurance product and insurance tariff are of course taken into account in line with the insurer’s specifications.

The insurance products that are sold can be defined flexibly and different details can also be mapped depending on the sales channel. This plays a particularly important role in self-service (sales channel self-service (web/app), where borrowers should not be overwhelmed with too many options. In addition, a personal consultation, for example by telephone with an advice centre or on site at the branch office, can provide full flexibility with regard to the scope of insurance and the level of insurance cover of the respective insurance company in line with requirements and situation at hand.

The regulations in the EU Insurance Distribution Directive - IDD for a loan application system are taken into account, including, for example, the consideration of the obligation to provide further training for consultants as well as the product information documents and the possibilities of individual, needs-based and situation-based consulting, including documentation.