The Fair Value DCF is calculated based on the discounted cash flow method. This method takes into consideration all risks associated with financial instruments. These include:

- cash flow timing and variability,

- benchmark market rate risks,

- credit risk (captured through credit spread),

- credit risk mitigation instruments,

- risk of embedded options (captured either through option pricing models or on a retail portfolio level through e.g. prepayment curves),

- liquidity and operational costs (acquired through an initial residual spread incorporated in the discount rate).

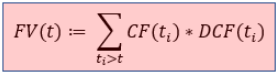

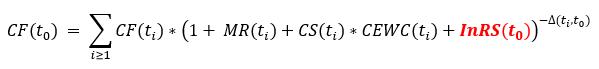

The discounted cash flow method derives the fair value of a loan at time t via

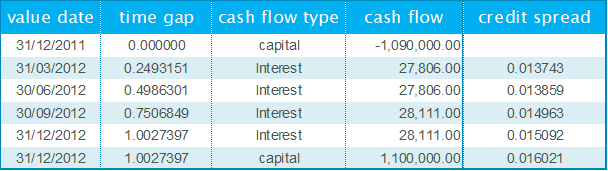

where CF(ti) are the expected future cash flows of the loan. A fair value calculated with the discounted cash flow method differs from the classical present value through the rates used in the discounting: While the classical present value only incorporates the market interest rate, the discount factor DCF(ti) incorporates all of the following elements:

- market interest rate

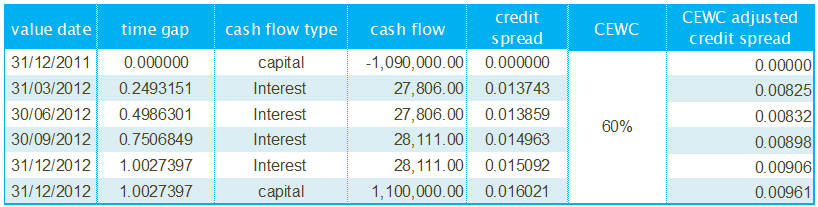

- credit spread and collateral enhancement weighting coefficient

- initial residual spread

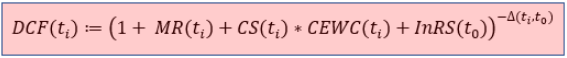

To be more precise, the discount factor at payment date ti used in the calculation of fair value is obtained by

where

- MR(ti) denotes the market interest rate at payment date ti,

- CS(ti) stands for the credit spread of the counterparty at payment date ti,

- CEWC(ti) denotes the collateral enhancement weighting coefficient of the deal at payment date ti,

- InRS(t0) stands for the initial residual spread of the deal conclusion date t0 and

- Δ(ti,t0) denotes the time gap between payment date ti and deal conclusion date t0.

Deriving the fair value using the above formula for the discount factor leads to the calculation of a fair value.

Please find below additional information regarding the following topics: