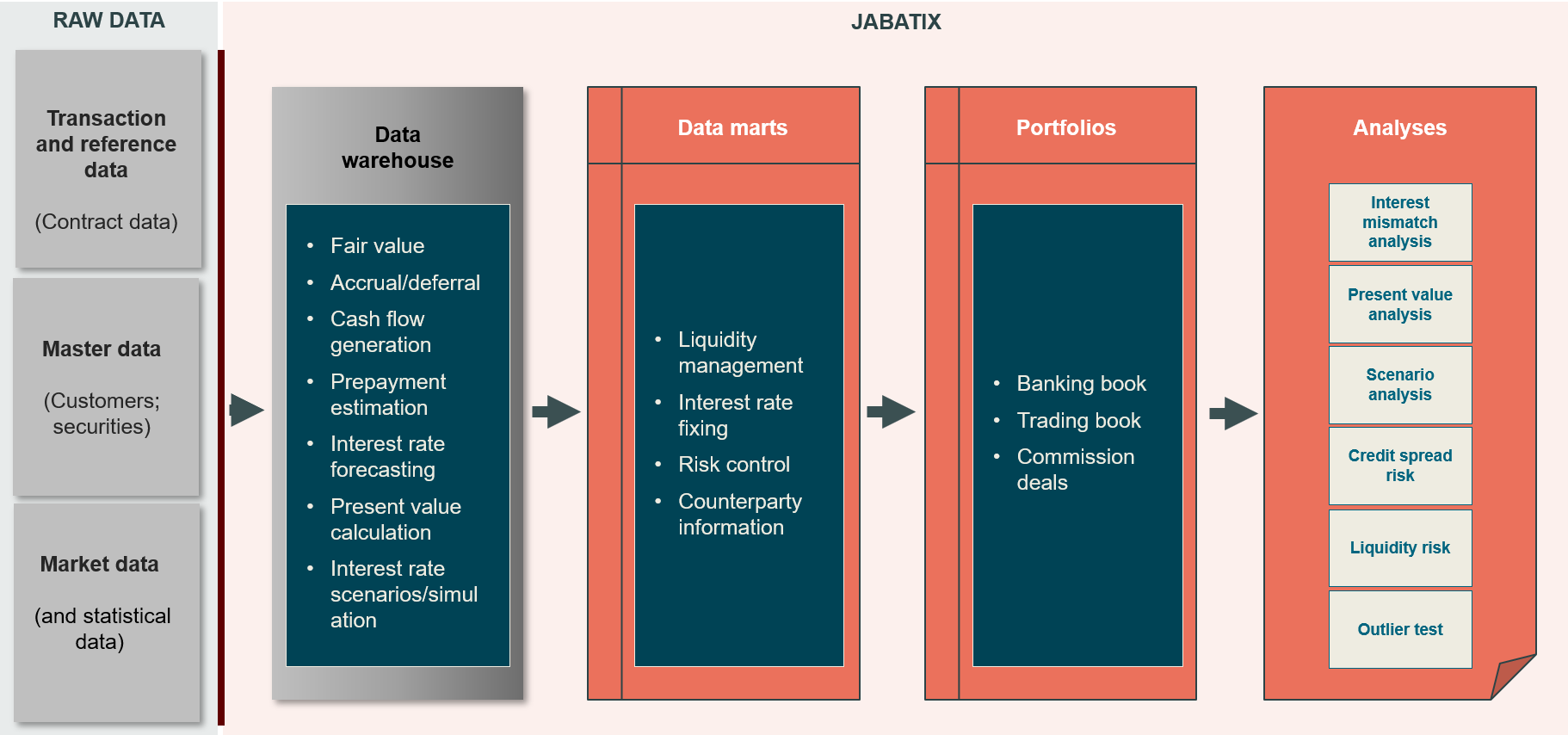

Individual data marts are filled in accordance with the topic in question using deal, master and market data and can then be used to develop any portfolio such as the trading book, banking book or commission deals. For example, in this case, data marts can be:

- Cash flows in the liquidity statement

- Fixed interest statement

- Risk ratios such as fair value, present values or value at risk

- Counterparty information

All relevant information such as cash flows, present value or fair value are provided in the data marts for the application in question. On the basis of these data marts, the portfolios form the basis for further analysis. Diverse business scenarios are applied in line with requirements. For example, business scenarios may be the planning of new business, market data scenarios or even default scenarios which are then included, for example, in the calculation of the liquidity gap analysis. Other examples of analyses are the interest mismatch analysis or present value analysis.