The Fair Value DCF is calculated based on the discounted cash flow method. This method takes into consideration all risks associated with financial instruments. These include:

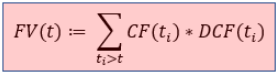

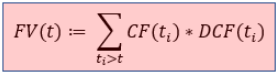

The discounted cash flow method derives the fair value of a loan at time t via

where CF(ti) are the expected future cash flows of the loan. A fair value calculated with the discounted cash flow method differs from the classical present value through the rates used in the discounting: While the classical present value only incorporates the market interest rate, the discount factor DCF(ti) incorporates all of the following elements:

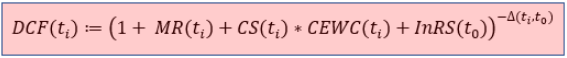

To be more precise, the discount factor at payment date ti used in the calculation of fair value is obtained by

where

Deriving the fair value using the above formula for the discount factor leads to the calculation of a fair value.

Market Interest Rate:

The market interest rate can be derived from delivered market data such as LIBOR, swap rates etc. Alternatively, it can be imported from front office or market data resources such as Bloomberg, Reuters etc.

Credit Spread:

The credit spread is the risk premium on the market interest rate which depends on the credit rating of the counterparty. It represents the yield difference between sound government-issued bonds and corporate bonds.

Example: One deal with customer rating Aaa and one deal with customer rating Ba are considered.The market interest rate is 4% and the funding spread 0.5%. The credit spread for companies with an Aaa rating is 0.25% and the credit spread for companies with a Ba rating is 0.75%. Then the interest rate for the first deal will be 4.75% (= 4% + 0.5% + 0.25%) and the interest rate for the second deal will be 5.25% (= 4% + 0.5% + 0.75%).

Based on the raw statistics delivered, for example probabilities of default, credit spreads can be derived by the solution via various tools and methodologies. Alternatively, credit spreads can be delivered from market data providers, front office or risk system resources.

The following situations may result in a change in credit spreads:

Collateral Enhancement Weighting Coefficient

The collateral enhancement weighting coefficient (CEWC) determines a reduction in the credit spread of a loan due to collateral instruments and describes the percentage by which the collateralisation reduces the risk of an asset. It is a constant between 0 and 1. For a loan perfectly covered by collateral, the CEWC will be 0. If a loan has no collateral at all, the CEWC equals 1. In general, if a deal is collateralised with p% of its outstanding payment, its corresponding CEWC is (100-p)%.

In order to determine a CEWC, the following approaches can be used:

Initial Residual Spread:

The initial residual spread (InRS) is a constant value which is calculated as a residual amount on the deal conclusion date. The InRS is calculated so that, on the deal conclusion date, the fair value of the deal on the start date corresponds to the cost of purchase, i.e. on the deal start date, the sum of the discounted cash flows corresponds to the cost of purchase. When the “price” of a financial product (e.g. a loan or a bond) is determined by the bank, several components are taken into account, e.g.

Due to the following reason, knowing the InRS is important in the accounting world:

Hence, the InRS can be understood as the profit margin of a deal.

Basically, the idea of the InRS is that it will be calculated only once at the beginning of the lifetime of a financial instrument. However, the following situations can be seen as comparable to the “birth” of a new financial instrument so that the InRS has to be recalcualted: