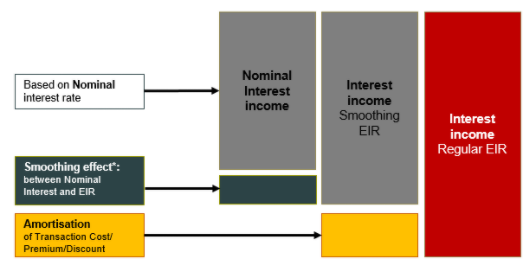

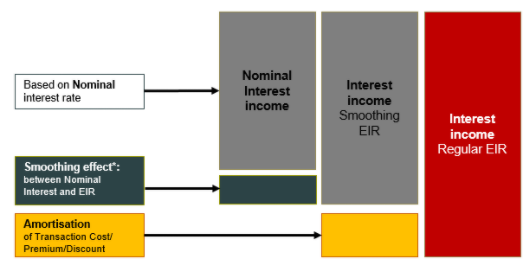

In view of the fact that entities became accustomed to posting interest on the basis of the nominal interest rate, the EIR contains more components that were treated differently in traditional accounting practice:

For a financial instrument with premiums/discounts/charges/transaction costs, the sum of the three components “nominal interest income”, “smoothing effect” and "amortisation" represents the theoretical effective interest as defined in IFRS 9.

While interest income has to be posted on the basis of the effective interest method, it is still up to an individual entity (with approval from the auditor and the regulator) to interpret the standard. More specifically, an entity has a certain flexibility with regard to deciding how to post the different components as part of the effective interest. During the implementation of the standard, various practices/interpretations have emerged:

Practice 1: Interest income is posted directly on the basis of the EIR. It means that all components of the effective interest are posted to the P&L "in one piece".

Practice 2: Post amortisation in interest results on top of the nominal interest. As such, the amortisation of premiums, discounts, charges and transaction costs is based on the effective interest method, whereas the recognition of the nominal interest and the amortisation in the interest result ensures consideration of the effective interest income, as required by IFRS 9.

While either practice has been accepted by auditors and regulators, and the impact of the difference between these two practices on financial statements can be immaterial, using different practices can have a significant impact on technical performance.

Nevertheless, keeping all valuation components separate

Considering the same sample deal as before, the smoothing EIR is calculated in addition to the regular EIR. Ignoring the inital discount with a value of 3000, the following equation needs to be considered now in order to derive the smoothing EIR:

The solution to the equation results in an approximated value for EIR = 6.137883%: |