Highlights:

|

The blue print Financial Accounting deals with requirements related to financial accounting, taking GAAP-specific requirements into account.

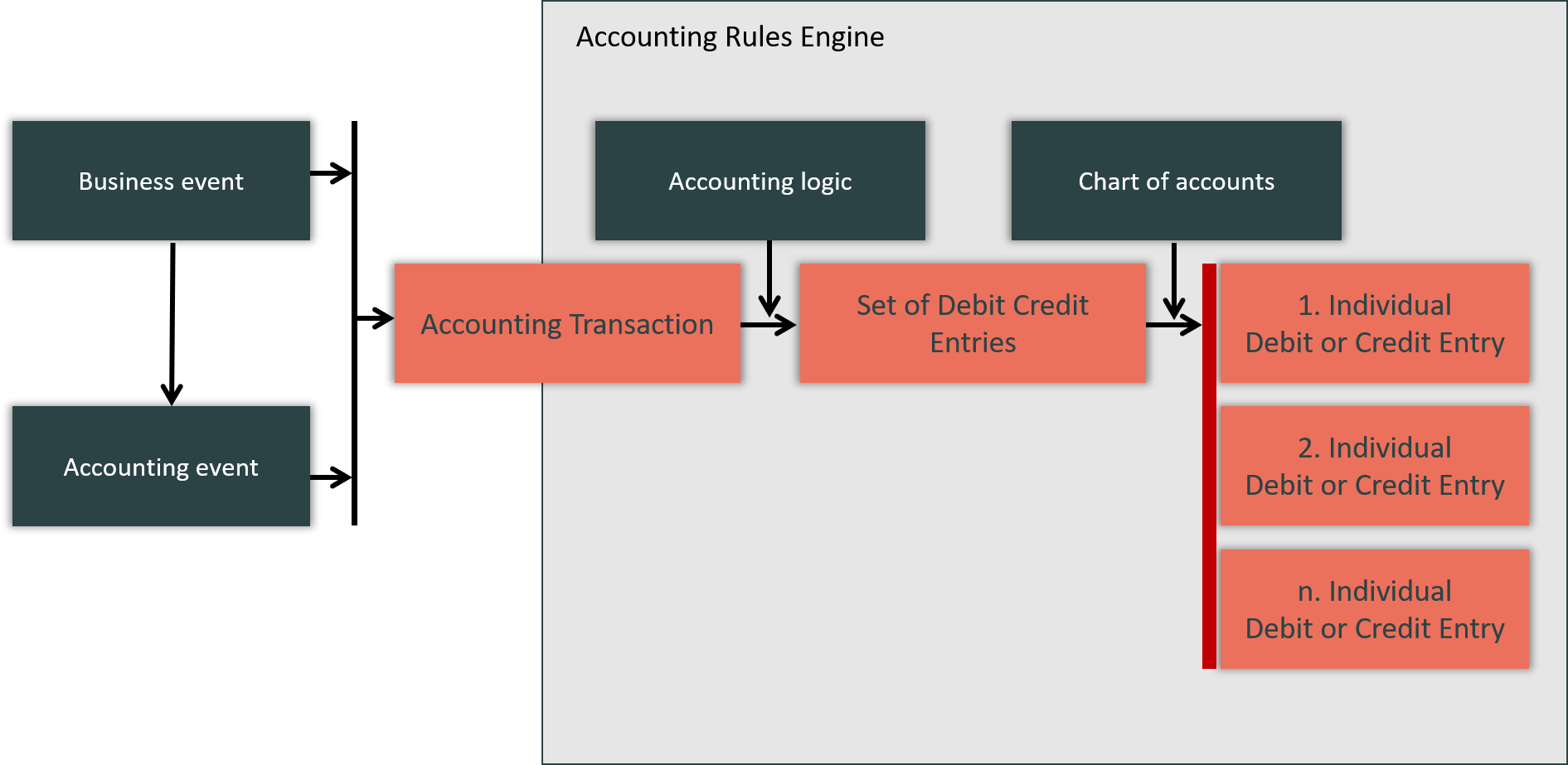

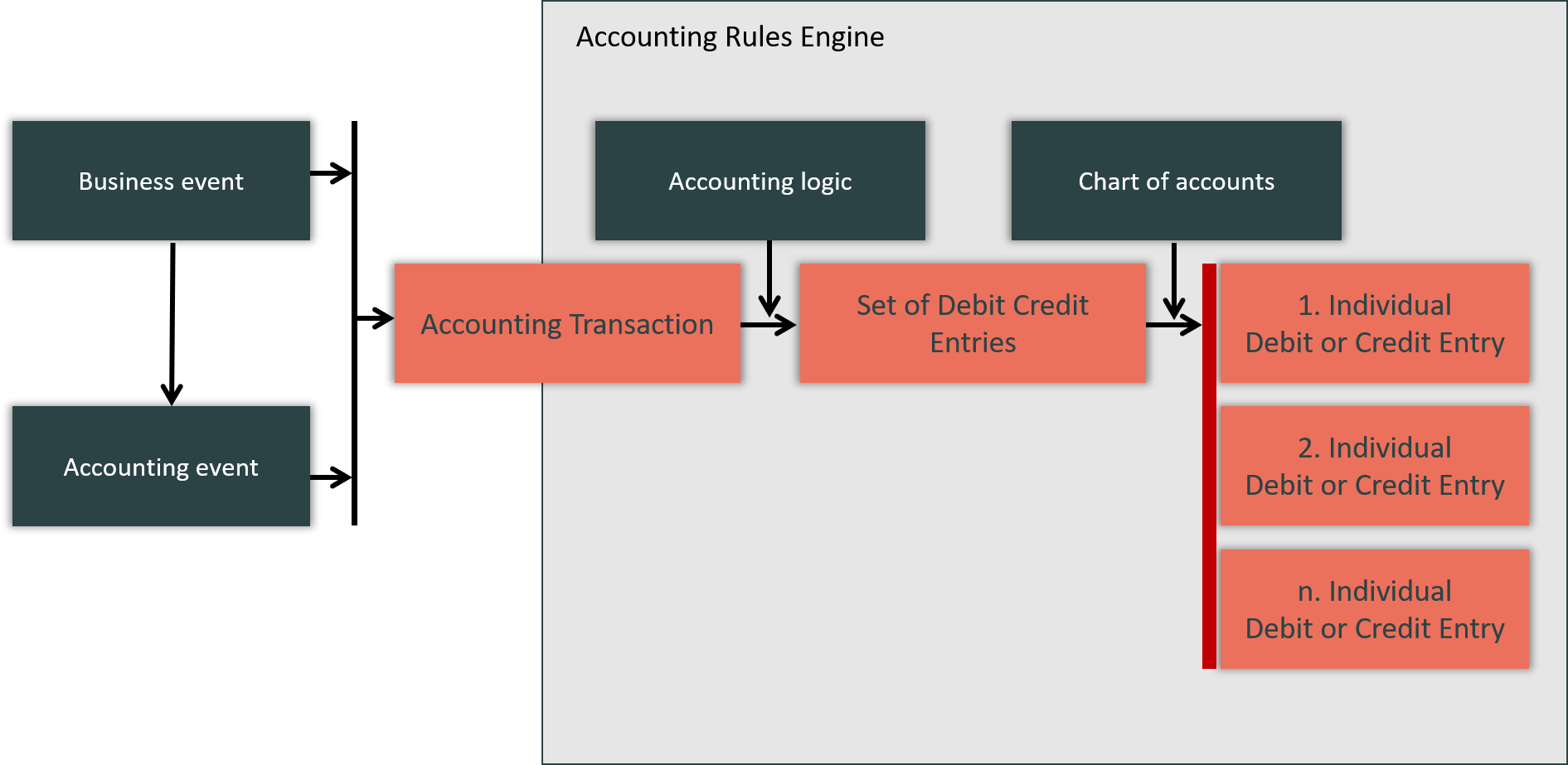

The Accounting Rules Engine (ARE):

The financial accounting provided is event-based: journal entries that cover the entire life cycle of a financial or non-financial deal are generated on the basis of business events and periodic accounting events.

It is possbile to run multiple GAAPs in parallel or use as an adjustment accounting for a master GAAP.

For this purpose, it uses a separately configurable accounting logic for each GAAP and transfers accounting transactions into debit/credit entries.

The generation of debit/credit entries is provided in two steps:

For both steps, the individual configuration of accounting logic and general ledger account assignment rules is supported. This enables an entity to consider the individual accounting policy and to use an individual chart of accounts.

Figure: Functional process steps of the accounting rules engine

Accounting transactions

Business events and periodical evaluation events are referred to as accounting transactions.

The Accounting Rules Engine expects the delivery of accounting transactions. Accounting transactions can be derived for specific types of events such as valuation, payment etc. through separate components. These separate components link other components such as Hedge, Impairment or Valuation with the Accounting Rules Engine.

An accounting transaction consists of parameters that describe the event, the link to the underlying financial or non-financial instrument, organisational characterictics, measures and ratios that help to calculate the amount to be posted and others.

Accounting transactions can be:

into account.

Accounting logic

The accounting logic links the accounting transaction with the set of entries.

A wide range of descriptive parameters can be used for the definition of the link between accounting transaction and set of entries as well as the link between general ledger account group and individual general ledger account. The following list of parameters provides examples only:

Set of entries

A set of entries consists of several individual debit and credit entries.

In the setup of the set of entries, the individual entries are defined as follows:

The number of debit/credit entries is not limited.

Chart of accounts

Individual debit and credit entries will be generated during the journalisation process, after the accounting transaction has been imported and the appropriate set of entries has been identified. In order to generate individual debit or credit entries, the Accounting Rules Engine makes use of a configurable chart of accounts. Specific account assignment rules can be defined for each general ledger account number.

Individual debit/credit entries

For each individual debit and individual credit entry, the

The account number assignment process selects all general ledger accounts for the configured group of general ledger accounts. Such a group can consist of one or more individual general ledger accounts. For the posting process, the general ledger account that fulfills the account assignment rule and has the highest number of hits will be selected.

Jabatix provides special templates for the set of entries for every financial product, every event, every GAAP. These standard sets of entries can optionally be adapted individually to each customer requirement.