...

| Expand | ||

|---|---|---|

| ||

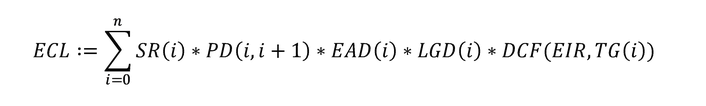

The calculation of Expected Credit Loss in general is based on the following parameters: PD, LGD, EAD and takes probability-weighted macroeconomic scenarios into account. For PD and LGD for combinations of segment and stage values can be configured. These values can refer to internal or external sources. In case the source provides only a loss rate, the lossrate loss rate shall be captured as LGD and the PD shall be set = 1. For different time periods over the lifetime of a financial instrument, different EAD are calculated, e.g. EAD in 3 months, 6 months, 1 year, 2 years etc. This approach takes into account that for a financial instrument with a regular repayment plan, e.g. annuity, the EAD for future periods will be different to the current book value due to repayments. To reflect possible repayments, the estimated cash flow plan over the lifetime of a financial instrument is generated on the basis of the contractual agreement. On the basis of the cash flow plan, the EAD for different periods in the future is calculated using the amortised cost and the adjustment of 3 months overdue which may occur before default. In particular, the expected credit loss for loss for an individual deal applying the probability-weighted approach is based on the following formularformula: Here,

This Expected Credit Loss is the lifetime value of the deal, covering its whole remaining term. For deals in stage 1, where the credit risk did not increase significantly since initial recognition, n is adjusted accordingly so that it covers 12 months. Consideration of macroeconomic scenarios is considered in configured values for PD and LGD. |

...

| Expand | ||

|---|---|---|

| ||

The calculation of Expected Credit Loss Stage 2 is based on the same approach like for Expected Credit Loss Stage 1. For deals in stage 2, the parameter n in the formular parameter n covers formula covers the remaining lifetime of the financial asset. |

...