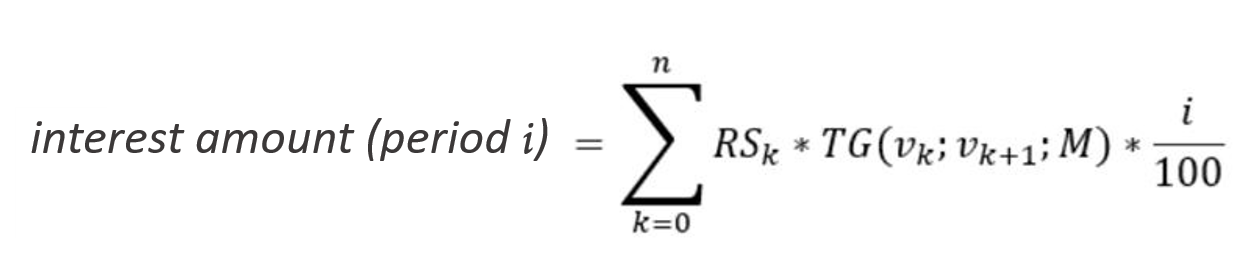

The amount to be accrued/deferred for an interest payment in arrears depends on

- the length of time within the interest period,

- the day count convention and

- the remaining debt on which interest is to be paid.

If one or more repayments or capital increases are due within the accrual period of an interest period, the relevant period of the interest period is divided according to the respective changing interest-bearing residual debt for the calculation of the accrued interest. In the calculation, the period to be accrued is divided into appropriate sub-periods according to the number of repayments. The remaining debt in these sub-periods is different.

where

n: Number of capital changes (repayments, increases or capital interest) in the accrual period of an interest period.

RSk: Remaining debt after the k-th capital change in the accrual period of the interest period.

If interest is capitalised, the remaining debt is changed. In this case, it should be noted for the above procedure that the remaining debt must be adjusted accordingly. With regard to annuities, the amount paid contains the interest as well as the repayment due. In this case, the repayment portion results from the annuity amount delivered and the interest portion to be paid. Therefore, this affects the repayment portion and thus the remaining debt still valid for further interest calculations.

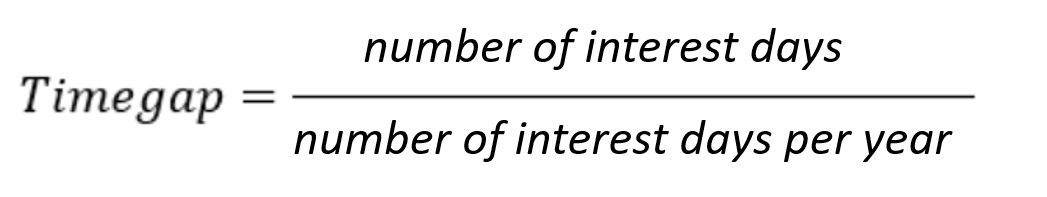

TG(vk,vk+1,M): Time gap from the period vk: to vk+1 for the day count convention M

The time gap is defined as the quotient:

The number of interest days and interest days per year depends on

- the day count convention

All current day count conventions are supported - the day count convention type

The day count convention type decides if the first, the last or both days are considered as interest-carrying days in an interest period. The day count convention type can be defined in general for the tenant (COMPANY), on the basis of the deal type level (CONTRACT_B) or at individual deal level.

vk: Value date for the k-th capital change in the accrual period of the interest period.

M: The day count convention that is applied for the interest rate delivered. This is also delivered at the interest tranches.

The interest amount to be accrued is calculated in the currency in which the remaining debt was determined. If the interest payment is made in a currency other than this currency, it has to be converted accordingly. A conversion rate between the two currencies from the conclusion date of the contract (field TRS_DATE in the delivery of the deal data) is used. This conversion rate can be delivered in the interface. If this is not the case, it is determined from the market data delivered at the deal conclusion date.